Calculate Your Debt-to-Income Ratio – Your debt-to-income ratio (DTI) is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debt—such as a mortgage or a car loan. It’s also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

How to Calculate Your DTI

To calculate your debt-to-income ratio, start by adding up all of your recurring monthly debts. Beyond your mortgage, other recurring debts to include are:

- Auto loans

- Student loans

- Minimum credit card payments

- Child support and alimony

- Any other monthly debt obligations

Next, determine your gross (pre-tax) monthly income, including:

- Wages

- Salaries

- Tips and bonuses

- Pension

- Social Security

- Child support and alimony

- Any other additional income

Now divide your total recurring monthly debt by your gross monthly income. The quotient will be a decimal; multiply by 100 to express your debt-to-income ratio as a percentage.

Can You Afford That Big Purchase?

If you are considering a major acquisition, you should take into account the new purchase as you work out your debt-to-income ratio. You can be sure that any lender considering your application will do so.

You can use an online calculator, for example, to estimate the amount of the monthly mortgage payment or new car loan that you are considering. Comparing your “before” and “after” debt-to-income ratio is a good way to help you determine whether you can handle that home purchase or new car right now.

Let’s see how that could translate into a real-life situation.

Example of a DTI Calculation

Here’s a look at an example of a debt-to-income ratio calculation.

Mary has the following recurring monthly debts:

- $1,000 mortgage

- $500 auto loan

- $200 student loan

- $200 minimum credit card payments

- $400 other monthly debt obligations

Mary’s total recurring monthly debt equals $2,300.

She has the following gross monthly income:

- $4,000 salary from her primary job

- $2,000 from her secondary job

Mary’s gross monthly income equals $6,000.

Mary’s debt-to-income ratio is calculated by dividing her total recurring monthly debt ($2,300) by her gross monthly income ($6,000). The math looks like this:

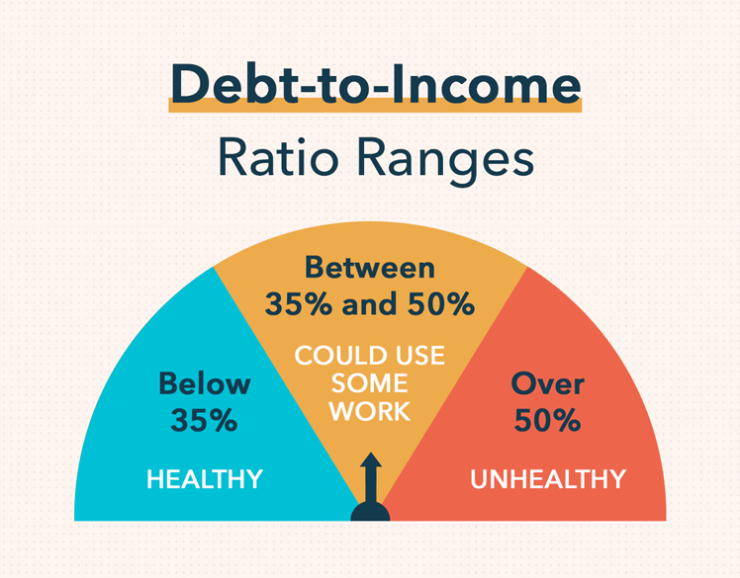

Debt-to-income ratio = $2,300 / $6,000 = 0.38

Now multiply by 100 to express it as a percentage:

0.38 X 100 = 38%

Mary’s debt-to-income ratio = 38%

Less debt or a higher income would give Mary a lower, and therefore better, debt-to-income ratio. Say she manages to pay off her student and auto loans, but her income stays the same. In that case the calculation would be:

Total recurring monthly debt = $1,600

Gross monthly income = $6,000

Mary’s new debt-to-income ratio = $1,600 / $6,000 = 0.27 X 100 = 27%.

Maximum savings with minimum hassle. That’s what a Discover Online Savings Account is all about. With no monthly fees and no minimum opening deposit, you’ll be able to make the most of your savings and earn interest over 5x the national savings average. Enter Offer Code DD124 and earn up to a $200 bonus on your first Discover® Online Savings Account after depositing at least $25,000. See advertiser website for full details.

Realeyated Topic :

1. Exchange Currency Without Paying High Fees